tax credit survey reddit

Free Rainbow 6 Credits. Ive filled out maybe a hundred different applications and this is the first time Ive come across this.

Swagbucks Hack 2017 Swag Bucks Codes Hack Daily Updated Swagbucks Codes Free Swagbucks Swagbucks

It is a game that has been adapted from Tom Clancys famous 1998 novel Rainbow Six.

. The answers are not supposed to give preference to applicants. Is this a normal thing. Learn more about WOTC COVID-19 Employee.

It will only be used to determine and document our companys eligibility for the tax benefit. WOTC Improve Your Chances of Being Hired. Internal data must be verified in order to ensure accurate data when filling out tax credit surveys.

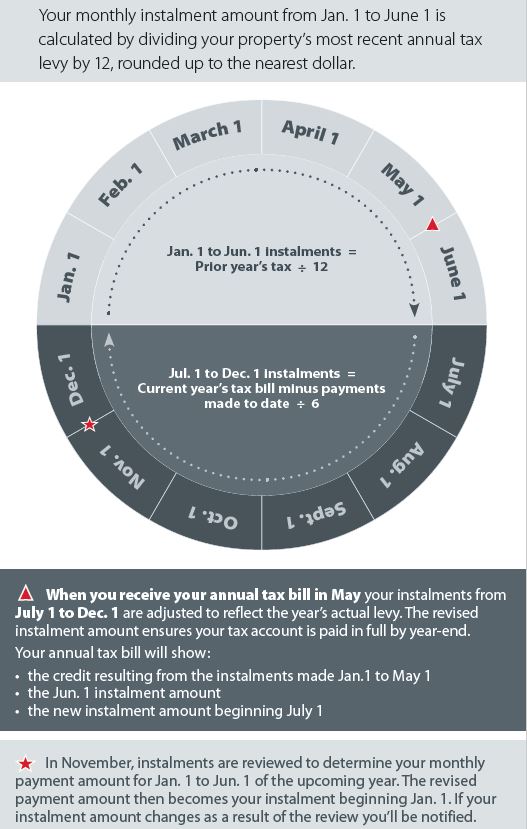

Posted by 1 year ago. A man fills up his truck with gas in Toronto on April 1 2019. You must mail or fax the Rural Area Application for New Employee BO Tax Credit within 90 days of filling the first qualified position.

Answered December 20 2020 - Dialysis Technician Former Employee - Michigan City IN. Its asking for social security numbers and all. Submitting SSN for Tax Credit Screening on application.

The website on the search bar is wotcgsey. So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit. In order to maintain the CONFIDENTIALITY of your answers we contracted with R.

Using your computer or mobile device please visit. To create and administer this survey. Theyre asking for my ssn for a tax credit survey.

Hi dev you said that if we buy game we get 50 free credits why are you charging for empty program Showing 1-4 of 4 comments. So I just finished applying for a job with a big fortune 500 company and at the end of filling out their online application I was taken to a required survey to determine if hiring me would net the company a tax credit. The Work Opportunity Tax Credit WOTC can help you get a job.

Employers may ask you certain WOTC screening questions to determine if they are eligible to apply for the tax credit. 4000 BO tax credit for each qualified position created with annual wagesbenefits of more than 40000. I dont feel safe to provide any of those information when Im just an applicant.

Its a required field on the 2nd stage of an application before doing an interview. This questionnaire will not impact your personal information tax status or employment application in any way. Thus the maximum tax credit is generally 2400.

A 25 rate applies to wages for individuals who perform fewer than 400 but at least 120 hours of service for the employer. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. Performs at least 400 hours of services for that employer.

Jeffrey Associates Inc. I also thought that asking for a persons age was discriminatory. A tax credit survey checks to see if the quality assurance service technical equipment including software systems databases and analytics works properly.

Stephanetotem developer Apr 23 2019 600am Hi KING-45 sorry for the inconvenience we had a little bug on our end it is fixed now you can closerestart iStripper and you should see your credits. It asks for your SSN and if you are under 40. Rainbow Six has been one of the most popular games of the late 20th and early 21st century.

Submitting Form 8850 to the SWA is but one step in the process of qualifying for the work opportunity credit. Apparently they can receive tax credits for hiring people. Employers who take advantage of those credits actually screen people and report when they hire someone who fits the bill can save a good deal of money.

Voters across the political spectrum support extending the expanded program that has lifted millions out of poverty. This tax credit may give the employer the incentive to hire you for the job. As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups.

Yes we can do that. I have never came across it before. At the low end of the scale a WOTC-certified new hire working at least 120 hours in the year could qualify you as the employer to claim 25 of the first years wages for a tax credit of as much as 1500.

But to increase their chances of getting hired the feds offer tax credits. 78 of Democrats Support Child Tax Credit Effectively Killed Off by Manchin. Im filling out an online job application chilis.

The information that you provide will NOT affect your employment wages or taxes. Files must be less than 5 MB. Thats all the screening is.

The website on the search bar is wotcgsey. Asked October 27 2016. WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment.

Theyre asking for my ssn for a tax credit survey. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. Work Opportunity Tax Credit ServicesEmployee Retention Tax Credit ServicesResearch Development Tax Credit ServicesEmployment and Income Verification Services Our Solutions Work Opportunity Tax Credit Expect the technology service and performance that your company deserves.

Thats a lot of money compared to the short amount of time it takes to screen new hires. I dont just give anyone my SSN unless I am hired for a job or for credit. THE CANADIAN PRESSChristopher Katsarov.

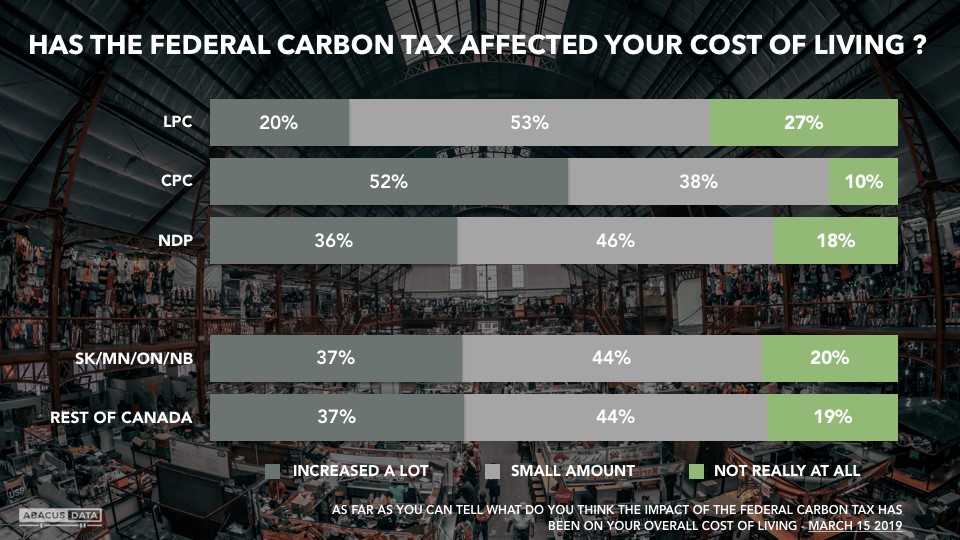

Up to 24000 in wages may be taken into account in determining the WOTC for certain qualified veterans. Attitude on carbon tax rebate defined by politics not facts survey suggests. Poll Survey shows that majority of all US.

The state work opportunity tax credit WOTC coordinator for the SWA must certify the job applicant is a member of a targeted group. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Help Reddit coins Reddit premium.

IStripper-Hack-Credits US FREE Online iStripper Hack Credits Mod - Unlimited Credits Cheats ipa apk ANDROID-PC-iOS No Download Jailbreak Required. Payroll records must also be verified. After starting work the employee must meet the minimum number-of-hours-worked requirement for the work.

From the research Ive done its apparently used to see if I would gain the employer a tax credit. Do you have to fill out Work Opportunity Tax Credit program by ADP.

Recommendation Letter By A Coworker How To Create A Recommendation Letter By A Coworker Download This Re Letter Of Recommendation Reference Letter Lettering

How To Save On Your Cell Phone Bill Without A Family Plan Cell Phone Bill Family Plan Cell Phone Plans

Goodbye Godsend Expiration Of Child Tax Credits Hits Home

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Longitudinal Administrative Data Dictionary 2012

Free Bitcoin Trading Profit Loss Ms Excel Calculator For Crypto Traders Microsoft Tutorials Office Games Seo Book Cryptocurrency Trading Trading Bitcoin

Insufficient Sleep By County 2 Who S Not Sleeping Data Interestingdata Beautifuldata Visualdata Map Information Visualization County

How I Got 100k Views On Linkedin In Just 30 Days Organically Growthhacking Startup Creativitybooster Market Money Online Rich Women Small Business Software

Changes In Life Expectancy Of African Countries 1990 To 2015 Ap Human Geography Map Life Changes

Cyprus Bank Of Cyprus Proof Of Address Bank Statement Template In Word Format Statement Template Bank Statement Templates

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

In A Poll 80 Of Canadians Responded That Canada S Carbon Tax Had Increased Their Cost Of Living The Poll Took Place Two Weeks Before Canada S Carbon Tax Was Introduced R Canada

Pin On Earn Money Online Browsing

Simple Tax Tips To Help Couples Score Big On Their Tax Returns National Globalnews Ca

77 New Image Of Resume Samples For Business Development Officer

Why The Child Tax Credit Matters Hub

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times