estate tax changes over time

The modern estate tax was temporarily phased out and repealed by tax legislation in 2001. Just four years later people with incomes of 500 faced a 23 tax and the rates climbed up to 94.

Potential Changes To The Estate Tax Texas Trust Law

That amount increases to 1206 million for the 2022 tax.

. This legislation gradually dropped the rates until they were eliminated in 2010. The estate tax is a tax on an individuals right to transfer property upon your death. A lot of people have.

The current 2021 gift and estate tax exemption is 117 million for each US. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The Biden Administration has proposed significant changes to the.

All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. Estate tax revenues are projected to increase sharply after 2025 when the exemption amount is scheduled to drop see Figure 2.

The good news on this front is that the reduction of the estate and gift tax exemption from. Several key changes and the impact on estate planning are summarized below. The new law establishes that the estate tax rate is 35 beginning 1 January 2011.

Fraction thereof over 150000. If the estate representative did not file an estate tax return within nine months after the decedents date of death or within fifteen months of the decedents date of death if a six month extension. The top marginal rate which had been as high as 91 decreased dramatically.

Over time other provisions made shifting income to trusts less attractive. July 13 2021. 10000000 as adjusted for chained inflation presently 11700000 per.

Thankfully under the current proposal the estate tax remains at a flat rate of 40. By 1864 the mounting cost of the Civil War led to the reenactment of the 1862 Act with some modi-fications9 These changes included the addition of a. 19 Over the 20212031 period combined estate and gift tax.

And the rate table for. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified. 7 By 1945 43 million Americans paid tax and the yearly receipts were in.

In the Act of March 3 1917 the rates were. However the law did. The Estate Tax is a tax on your right to transfer property at your death.

Under the existing estate tax laws if the couple dies before 2026 they would not be subject to any federal estate taxes. Estate taxes are really a form of the government inserting and becoming the beneficiary or a large beneficiary of your accounts and your hard work. The Estate Tax is Reimposed.

Their estate would however still be subject to New York. Proposals to decrease lifetime gifting allowance to as low as 1000000. In 2022 you will be taxed if the total of the gross assets at hand exceeds 1206 million.

Entering World War I Congress enacted the current estate tax imposed at rates of 1 percent to 10percent on taxable estates over 50000.

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Senate Bills Propose Changes To Estate Tax Wealth Management

What Happened To The Expected Year End Estate Tax Changes

Planning Strategies Under A Lower Estate Tax Exemption Financial Planner Advisor In Se Wi Shakespeare Wealth Management Llc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

2018 Federal Estate Tax Law Changes

Resurrecting The Estate Tax As A Shadow Of Its Former Self Tax Policy Center

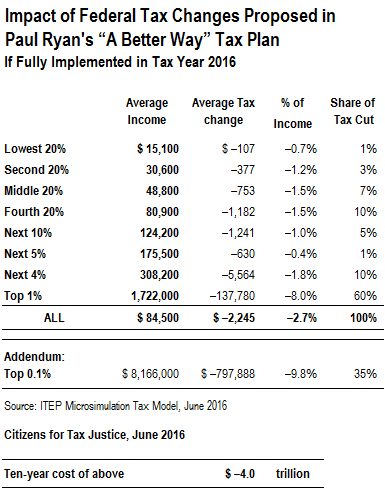

Ryan Tax Plan Reserves Most Tax Cuts For Top 1 Percent Costs 4 Trillion Over 10 Years Citizens For Tax Justice Working For A Fair And Sustainable Tax System

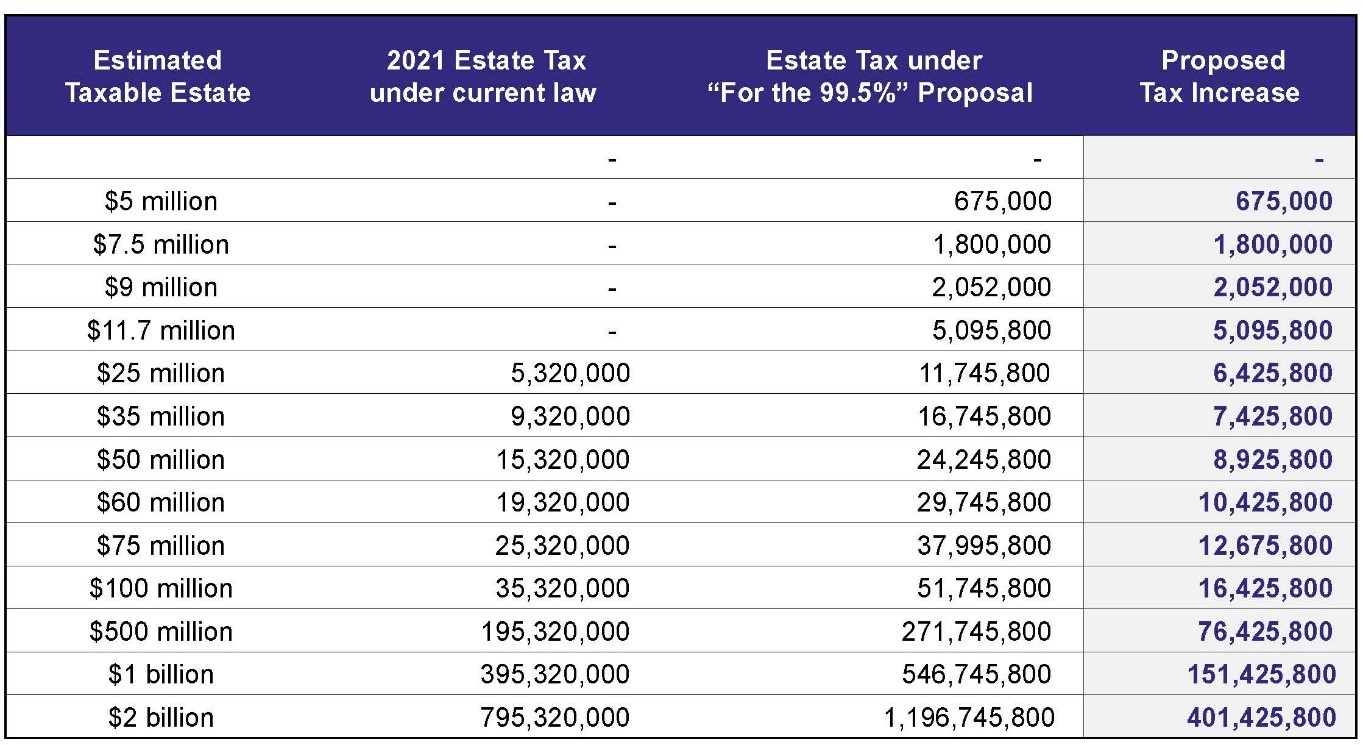

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Is The Estate Tax Really Double Taxation North Star Policy Action

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Tax In The United States Wikipedia

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

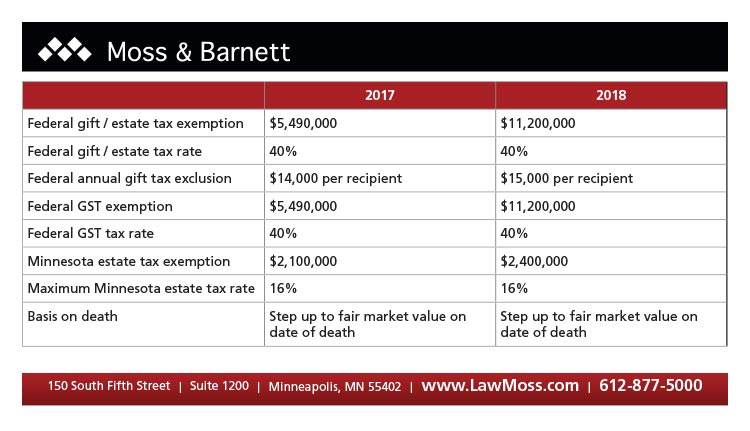

Estate Tax Alert Tax Cuts And Jobs Act Moss Barnett Minneapolis Law Firm Attorneys

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Estate Tax Changes Under Review Secure The Current Benefits Now Southpac Group

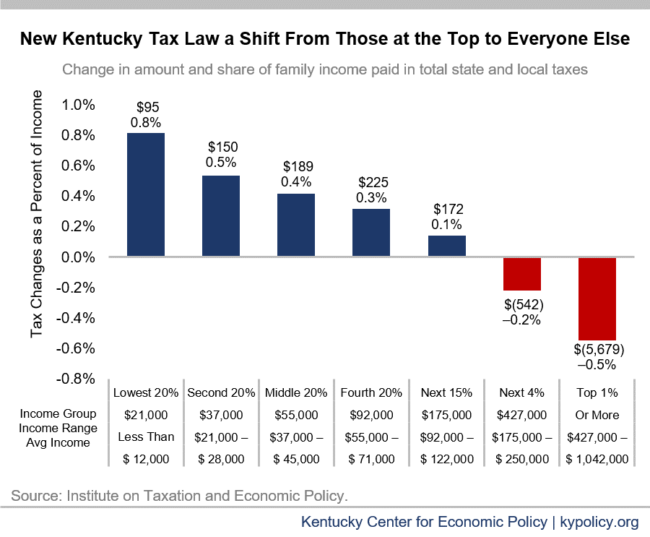

New Report Wealthiest Kentuckians Pay The Lowest Tax Rate And The Problem Is Worsening Kentucky Center For Economic Policy